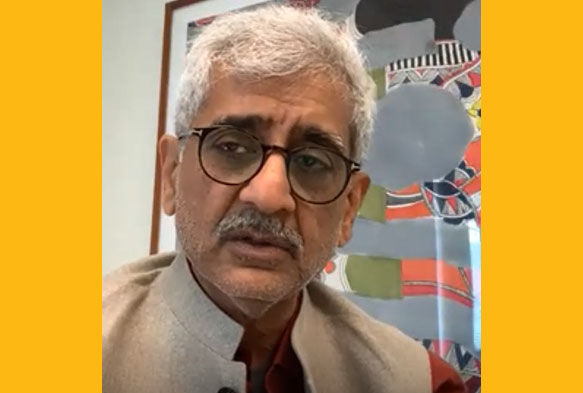

Supriya Dravid In Conversation With Darshan Mehta, President & CEO, Reliance Brands, On The New Meaning Of Luxury

WHAT MEASURES DID YOU TAKE TO PIVOT LAST YEAR?

We pioneered a concept of creating the theatre of sales online. We created groups of interesting customers, to talk

together, with our partner brands, head designers, people from the market and communications which was a big value add to customers who liked to engage closely with fashion. Imagine being able to talk to Burberry’s head of design and understand what goes into it and talk about the product.

In that process, sales and deliveries started happening. This is one of many examples of strategies that worked. As the year moved on, the customers rebounded quickly.

ONE YEAR ON, WHAT ARE THE CONSEQUENCES OF EVERYTHING YOU DID?

Surprisingly, it has been one of the best years. As a group, we have organised amazing fundraisers at different levels. As an integral part of overall retail business, a large chunk of which I run, we have welcomed some impressive global investors in our kitty but from a customer point of view, also, it has been one of our finest years.

One of our key interests is called ‘Like for Like Growth’. All over the world, we want to know how our brand is doing. Europe is of course deeply negative, the US is about negative, China is about anywhere between 8-12% positive on a full year basis. All our luxury brands, and we have a portfolio of 22 brands in that segment, are double digit

positive, so that is an incredible year.

Domestic travel has started, marriages are back albeit with fewer people invited. There is an over-index section that is happening in gifting because, obviously, less expense is happening on the other side of the expense related. So, distance selling is a new channel across more than 250 cities and towns and we have discovered new cities and towns. We do about 5000 new distance sales, one out of two customers is a first-time buyer in our portfolio brands, and we control virtually 80% of the market. These are new entrants. Maybe they are shopping abroad and now they are buying here, or they are finding out that we are able to access Guwahati, Coimbatore or Vishakhapatnam which are rich markets through distance selling channels.

ANY NEW PATTERNS BETWEEN THE WAY MEN AND WOMEN SHOP?

‘Athleisure’ is a trend as people think more about wellness. People are getting into athleisure which is athletic as well as leisure, both well-combined. A lot of comfort wear is happening. For instance, three years ago, I would not have thought that we could sell Cashmere track-suits to our Zegna customers. But we are doing so now. The difference is that instead of buying a Cashmere jacket, they are buying Cashmere track-suits.

In category after category, men are moving in a very big way to comfort wear. In Women’s beauty, women have more time to spend on a beauty regime. All our high-end customers typically spend between 45-50 minutes per day on three-four different sessions from morning to night. They use more than 40 products, right from the kajal pencil, skin care, face, so beauty as a category is well.

There is another interesting trend; people are moving to true luxury. Luxury is timeless, and they are celebrating special moments and a lot of gifting is happening through true luxury or they moving toward value, which is either bargain or bottom of the pyramid. The middle part of the pyramid is a bit serious and there is polarization to the very high-end or the very mass.

Decision-making is a big part of any form of luxury. It is the theatre that goes along when you go to measure your Armani suit, the whole drama, which is very enjoyable.

We classify our customers in 5-6 different buckets, and a new bucket has emerged, we call it a WhatsApp junkie. We started sending e-catalogues on WhatsApp and initially, people were unsure how they would buy through viewing catalogues on whatsapp. Six to eight months later, we see people whatsapping to ask when the new Tiffany’s catalogue is coming, when is the new Armani’s catalogue coming. So, every day, we are on WhatsApp. Newer ways of decision-making are shaping purchase behaviour.

SPEAKING OF TIFFANY, WE ARE USED TO LOCAL FAMILY JEWELLERS IN INDIA. YOU BROUGHT IN TIFFANY WITH RELIANCE BRANDS LAST YEAR AND NOW YOU ARE LAUNCHING AN INDIA-SPECIFIC E-COMMERCE SITE. HOW DO YOU NAVIGATE THIS MARKET WITH A GLOBAL HEAVY-WEIGHT LIKE TIFFANY, WHAT ARE ITS FAIR SHARE OF CHALLENGES IN MAKING IN-ROADS INTO AN INDIAN AUDIENCE WITH ITS OWN MIND-SET.

I must give Tanishq a lot of credit in this. In India, people tend break the bill up into materials: how much gold, what is the jewellery, how much diamond is in it and what is the component of labour. This is not how you buy jackets – no one asks what is the cost of the fabric or the buttons. But in India, people just don’t like to pay for the design. Rich people, too, have a family jeweller who can easily copy a design, come out with great craftsmanship and give you more gold for the money spent. In a big way, Tanishq has worked over the last few years, to people buying products without getting into the bill-up materials. Younger people in cities and towns are looking for instant gratification. They are not going to wait six weeks for the Babu to make it. Having said that, both Cartier and Bvlgari have had muted success. They came before us. In Tiffany, you have an absolutely amazing success. Possibly, what had added to what Tanishq has already done, is story telling – the famous Tiffany blue box, breakfast at the store… we have done half a dozen breakfasts at the store even in Covid times. We have had three people propose at the Tiffany store. Now we celebrate engagements and proposals at the store. The marketing aura around Tiffany has worked very well for us.

LET’S COMPARE MARKETS. HOW HAS INDIA FARED?

I think Europe is the worst-hit because of the second wave and multiple waves but, most importantly, the repatriation of the Chinese shopper who is back home. Europe has an aging population with largely tourism-dependent markets. Last year, we grew 28-30% but in Europe, the general belief is that 3 out of 4 companies will face closure in the fashion space. The US is a resilient market – at negative 12-15% – but it is hoped to recover in 2021.

The star, of course, is China, revenge-buying, 7-8% positive. China does not have any known second wave, Hong Kong had challenges even before the pandemic. But China is the lone star.

India would overall be a much smaller market, estimates of 5-7% negative, but we will also come out faster. Then, finally, the rest of Asia, at around 10-12% negative. Singapore was a big market, but any tourist-dependent market has been hit in terms of shopping. I admire how Chinese companies have pivoted in selling luxury and high-end products to their own customers both digitally and non-digitally as well.

YOU STARTED RELIANCE BRANDS IN 2007 AND MADE US REALISE THE BURGEONING OPPORTUNITIES AND THE VERY IDEA OF THE BUSINESS OF LUXURY. PLEASE SHARE YOUR JOURNEY.

Most of this business was run either by owner entrepreneurs, mostly rich people, family money, bored housewives, bored someone… luxury sounds sexy and glamorous and the kind of talent that was in this business was accordingly limited with kind of ownership that was driving this business. I didn’t grow up in a luxury background, so fresh eyes helped me. It was a business with few players and the rules had to be written from scratch. This was an opportunity. Reliance, a large energy or hydro-carbon company in 2007, Reliance Retail had just started. So for the first 12-18 months, getting into fashion- luxury was a write-off. I had to use my personal journey to say that we are taking a line of sight and building a strong foundation.

Luckily, I managed to attract high-quality talent because capital was not a constraint for us. I would like to thank my own board because they brought in a lot of patient capital because it is a long-term journey. We borrowed a lot from people then and we created our own talent board. We were lucky to strike some interesting partnerships early on, my Zegna partnerships, my research partnerships, Italian brands, I learned a lot from them.

Emporio, the first luxury mall in India, opened in 2008. Till then the luxury was in five-star hotels, like left over space.

It moved from there to a more mainstream sensibility in terms of the customer. Palladium Mall happened a bit later. Ten years on, more than 50 beautiful partnerships, joint ventures, and a happy journey later, I still believe that we are at a very early stage of the consumerism cycle in India. The good thing about all the good things in life is that there is no reverse gear. Once you wear a better jacket, better shirt, fly first or business class, you are not going to go to the class behind. You may buy less of it but there is really no reverse gear in humans.

I am excited about the next 10 years because the digital channel is the answer to creating scale.

WHAT EXCITES YOU RIGHT NOW?

I see us at the cusp of creating scale because brick and mortar stores are relevant only to build the halo of the brand but you can reach the customer digitally and efficiently.

Secondly, like I call talent-nomadism, talent has always been in short supply, which means we have discovered a unique way of working. The availability to be able to work virtually and more effectively, I can acquire talent from different and far corners of the world. I am no longer restricted to Bombay, Delhi and Bangalore in terms of talent outreach.

Thirdly, I think in this global tsunami, India is going to emerge stronger. Brands which always had India at the back burner have started India-related conversations. The kind of frequency of conversation over the last two months, people I was chasing for some time are coming the other way round. We are going to see a strong momentum building in India, people are discovering that this is a next big centre of gravity of consumption. So, these are the three things, scale, time of India and of course what I call is talent through digital nomadism.

WHAT DOES LUXURY MEAN TO YOU PERSONALLY?

Time is money. Generally, we are all drawn between the work space and personal space. The personal space is more often than not a family space and what suffers is the ‘me’ space. The luxury of creating time for myself and doing things that I like is to indulge in is true luxury.

ROTARIANS ASK

HOW DO YOU BRING THE SPIRITUAL ASPECT TO THE LUXURY MARKET?

Theatre and experience is a big part of what happens at the store. We book an appointment, someone explains to you the heritage, often you end up talking to head designers…. What we are doing is a clever integration of digital and physical stores. There are two huge centres in BKC in which a large scale of retail is coming up. We are building 40 new stores in Mumbai, 20 of them are opening in April. Conversation and retail therapy will never die out.

DO YOU SEE AN OPPORTUNITY FOR COOPERATIVE CONSUMPTION BETWEEN LUXURY RETAIL AND LUXURY SERVICES TYPICALLY HOSPITALITY AND TOURISM AND IF YES, WITH THE RATE THAT THIS DIGITAL RETAIL AND CONSUMPTION SECTOR IS MOVING, HOW CAN THIS SECTOR INCENTIVISE THE AILING HOSPITALITY INDUSTRY TODAY?

Currently, as we talk, I am in touch with Mr Bikram Oberoi to create a unique social programme between not just my set of brands but my consumers and the Oberoi Group of Hotels. We are actually building unique staycations in unique hotels. So, there is a lot of scope of cooperation.

WHEN TATAS STARTED TANISHQ, THEY WERE VERY SURE OF WHAT THEY OFFERED, BUT RELIANCE DOES NOT SHARE THE SAME REPUTATION. PLEASE COMMENT.

Reliance being a corporate, we don’t even have a separate website called Reliance Brands. Just yesterday, someone told me they went to Tumi at Palladium and found out, in conversation, that Tumi is also part of Reliance. That is the best compliment they can give me because they are going to Tumi to buy Tumi and not to buy a Tata or a Reliance. Our approach in this business is that whether you go to a Zegna, Brooks Brothers, Hugo Boss or a Giorgio, all come from the Reliance Brands table and none of them shouts, screams or even whispers Reliance Brands. They are required to recreate their own halo around what they do. We are more a consumer-facing brand in Jio.

IN TODAY’S ONLINE AGE, WHAT ARE THE CHALLENGES YOU FACE ON SUPER LUXURY PRODUCTS LIKE THE LADY’S BAGS WHICH COST RS 1.5 LAKH AND MORE SELLING ONLINE VIS A VIS THE ACTUAL ON SHOP TREATMENT GIVEN TO THEM?

It is more of an opportunity. From a marketing point of view, your opportunity for storytelling is much easier. The amount of research that people do helps a lot, it is a big part of the shopping. The ability to combine tech with human touch.

THE INDIAN CONSUMER TENDS TO BE A VERY VALUE FOR MONEY CONSUMER. IN TERMS OF LUXURY PLANS, HOW DO YOU SEE THAT UPTAKE? DO PEOPLE WHO BELIEVE IN THIS ALSO SHIFT TO LUXURY BRANDS?

The fallacy lies exactly there because in our mind the words value for money are equated to cheap. So, for example, India became the top market for Rado watches when it was doing very poorly in other parts of the world. A big case study was done to show that 10 years back, the average Rado watch cost a lakh rupees. Research suggested it did well because that watch signified your entry to a certain club. One lakh is a small price to show that you have entered that club. So, value for money is not cheap, the value is not to understand time – it is a piece of jewellery. When a lady wears a diamond necklace, it is value for money because it shows that you are already part of a certain class. As a brand you should make sure you do not frequently discount. Never go ahead of the distribution curve. Our own belief is if you manage the brand and if you do the storytelling and heritage, artist’s value, people value it.

HOW MUCH OF A CUSTOMIZATION DO INTERNATIONAL BRANDS DO AS PER THE INDIAN MARKET?

When it comes to fashion, clothing, you are actually buying a slice of a western world, when you are wearing a Ralph Lauren Polo, there are less than one per cent of people who buy Ralph Lauren. I haven’t even seen a polo match but, in a sense, it makes you feel younger and part of the sporty club. So, you are buying a slice of a certain life. My first suggestion is never, ever, customise because you will bring down the aura of that brand. If you are clever, do certain portions of it. you have to be careful not to overdo it.